Here are some of Dave’s key features: Loan amount. ️ No hidden … Borrow money until payday and improve your financial health using the Payday Loans Online app. Banking services provided by The Bancorp Bank, N. Brigit helps get your finances on track with instant cash advances, smart spending tips, gig work & more. Earnin is a popular paycheck advance app that lets users borrow up to $100 a day and up to $500 during each pay period - the largest cash advance limit of any app on this list. Cleo’s up to $250 cash advance has: - No interest (APR) - No credit checks. For example, as a first time Wonga customer you can apply for up to R4000 for a maximum of up to three months starting from the day you take out the loan. It’s your money, so there’s no reason you shouldn’t have access to it sooner. Instapay is available at no additional cost to Even members, though there may be an associated fee for the cash advance. The application process is simple and can take a few minutes. With a Dave Spending account, you can also get your paychecks up to two days earlier (2).

Cash advances and loans can be confusing, misleading, and … What’s great about the Heart Paydays platform is that you can be self-employed or a freelancer to apply for a $100 loan instant app, but must prove you’re generating at least $1000 per month. 12, including the 8% fee paid for the PayDay Advance loan. Here are six lending options that you may qualify for without a bank account: CDFI loans - Some Community Development Financial Institutions (CDFIs) offer payday loan alternatives that don’t require a bank account. Green Dollar Loans: Best Alternative to Any $50 Loan Instant App Online for Bad Credit. Once you connect your bank account, the Brigit app can predict your income needs. For example, in California the max you’d have to pay is $45 USD, because the new regulations have set that payday lenders can only earn a maximum of 15% of the total amount of the loan. NIRA Finance is the best app for salaried people where you can avail a loan up to 1 lakh on EMI using a secure 100% online process. PockBox doesn’t charge a fee for their service, but the lenders that offer you a loan might. You’ll get access to funds up to $5000 with 3 to 24 months to pay and interest between 5. The Brigit app allows users to link a checking account that receives a regular direct deposit so they can request up to $250 in payday advance funds at no charge. No fees or interest, just pay us back later. This loan app empowers you to borrow money instantly (up to $2,500), helping you overcome financial difficulties. Yet, the express fee, which varies between $1. The maximum loan amount is Rs 40 lakhs for salaried individuals and Rs 9 Lakhs for self-employed. MoneyLion provides you with access to 0% APR cash advances, low-interest personal loans, helps track spending and savings. FloatMe is an unemployment cash advance app that will “float” you up to $50 when you need it. Once applied, you will get a quick lending decision and your loan agreement.

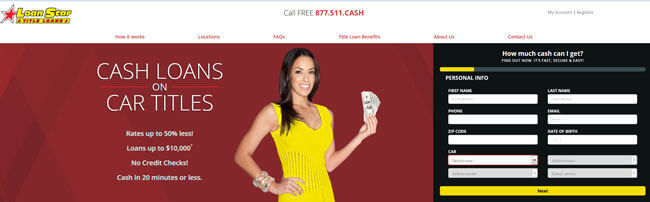

LOANSTAR TITLE FOR ANDROID

Good news: ASAP Finance payday advance app is available for Android devices as well.

LOANSTAR TITLE FREE

Get instant loan online in Delhi NCR, Mumbai, Pune, Bengaluru, Hyderabad, Chennai, Mangalore, Coimbatore, Mysure, Vishakhapatnam That said, it’s not entirely a free deal: Using the app costs $1 per month.

0 kommentar(er)

0 kommentar(er)